The Facts About Paypal Business Loan Revealed

Wiki Article

The Facts About Paypal Business Loan Uncovered

Table of ContentsPaypal Business Loan - An OverviewPaypal Business Loan - The FactsPaypal Business Loan for DummiesNot known Details About Paypal Business Loan The Basic Principles Of Paypal Business Loan Paypal Business Loan - Questions

Lots of service owners report sensation emphasized when using for a small business lending. Knowing which documents will certainly be needed and obtaining that documents in order prior to you apply for your service funding can minimize your tension and also speed-up approval of your loan.Be prepared to offer up to 2 years of history. Not all loan providers will certainly call for 2 years on all records, yet lots of will not call for more than that. PayPal Business Loan. In any instance, be prepared to provide all asked for paperwork.

The Greatest Guide To Paypal Business Loan

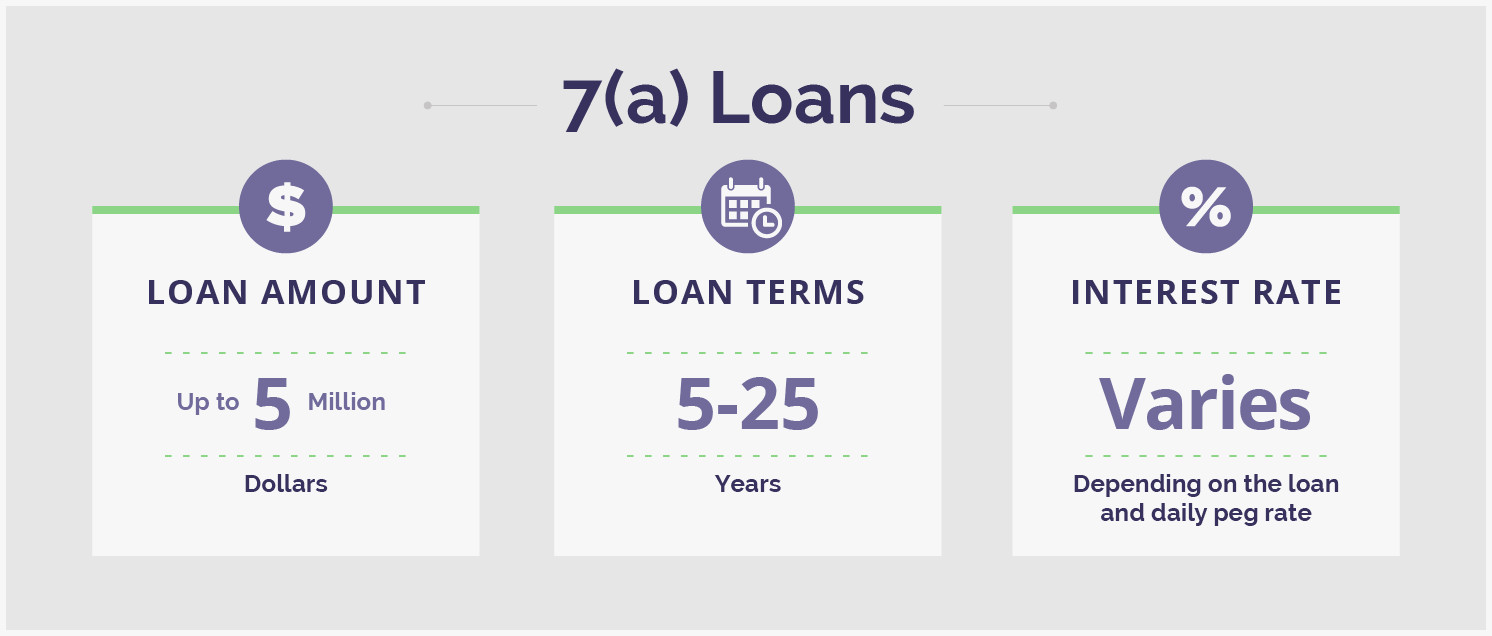

Yet you can pick from a variety of company financing kinds and ought to investigate your alternatives to find the best fit. Take into consideration the sorts of small-business loans you can pick from: SBA fundings. The SBA partially backs finances from offering companions, lowering their threat and also boosting accessibility to funding for tiny organizations.

Tools financing is a kind of term loan that can be utilized to acquire as well as expand the expense of equipment or tools for your organization. Generally, the tools is security for the financing. If your small company struggles with cash money circulation because you're waiting on billings to be paid, you can use billing financing, likewise referred to as factoring.

Getting The Paypal Business Loan To Work

Specific energy-efficient or manufacturing projects might qualify for more than one 504 lending of up to $5. Services may utilize calamity fundings to fix or replace machinery and also tools, inventory, and real estate that was damaged or damaged.Lots of small-business fundings can be used for a variety of service demands. Substantial documents called for. Small-business car loan applications can need a large amount of documents, which might make the procedure extensive. Limited options with poor debt. Small-business lending applications are based partially on credit, and there are few car loan options for services with poor debt.

Some on the internet lenders are considered different lending institutions, which can provide more versatility than commercial banks since their finance products are less regulated. Alternate loan providers provide loans to consumers that or else might not have access to small-business funding, such as startups or organizations with an unsteady monetary history."Tiny companies must realize there are several channels offered for borrowing required funds," states S.

8 Simple Techniques For Paypal Business Loan

Online lending institutions may supply SBA loan programs. You can likewise locate peer-to-peer lenders online that will attach your small click this site company with investors prepared to money your car loan. Dimension alone will not be adequate to get approved for a small-business financing. You should persuade the loan provider that your organization is worth the threat.For instance, you may get a various loan for pay-roll than you would certainly genuine estate. If a lender does not use financings in the quantity you require, discover one that will. Going for a reduced quantity could burden you with a funding that disappoints effectively resolving your funding needs.

Paypal Business Loan - Truths

Short-term organization fundings have greater month-to-month repayments than long-lasting financings, however you will normally pay much less in total interest since you have the funding for less time. The opposite is also real. A longer payment term can suggest reduced regular monthly payments yet even Check This Out more in overall passion costs over the life of the funding.Look for a lender with the cheapest expenses, consisting of: The interest rate is the rate of interest billed on your funding yearly, plus all fees as well as expenses connected with the lending. Promoted rate of interest rates may be where rates start; a price check can approximate an APR for your small-business lending.

Sometimes, the down repayment for your small-business finance is covered by security. Various other small-business financings require an equity investment. Down payment requirements vary, yet anticipate to invest at the very least 10% to 30% of your very own resources when taking out a loan. Aspect rate. An element rate is generally used for link merchant cash loan and also temporary company fundings to identify exactly how much you will owe in interest.

The Main Principles Of Paypal Business Loan

Personal fundings (PayPal Business Loan). Family members lendings.Advertising and marketing considerations may influence where offers appear on the website yet do not influence any editorial decisions, such as which finance items we discuss as well as exactly how we assess them. This website does not consist of all lender or all funding offers available in the marketplace.

Sometimes, a bank loan is the solution to assist you achieve your business goals. Prior to you start filling in applications, however, you'll intend to have a standard understanding of the little company lending landscape: what funding alternatives are readily available, which ones are prominent, and just how they work. In this overview, we'll cover those essentials as well as some alternatives worth taking into consideration.

Report this wiki page